ARE YOU MISSING AN IMPORTANT INVESTMENT OPTION THAT MAY BE IN YOUR 401k, 403b, 457 DEFERRED COMPENSATION PLAN AT WORK?

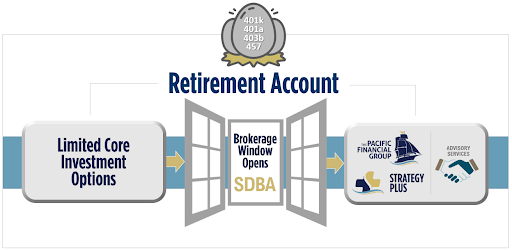

For many years, the investment options offered in company-sponsored retirement plans were limited to a pre-selected list of mutual funds and annuity contracts. However, thousands of employers have enhanced their retirement plans to include a brokerage window opportunity so that plan participants have more choice and greater flexibility with their retirement investments. This option, known as the Self-Directed Brokerage Account (SDBA), exists in 401(k), 403(b), or 457 plans where participants have access to stocks, bonds, mutual funds and ETFs.

Not only do brokerage accounts allow investors to choose from a vast array of investment options and expand the range of investment choices beyond their core investments, they can now have professional management advice on those assets.

According to Aon Hewitt, approximately 40% of retirement plans offer SDBAs. Hewitt also found that only around 3% to 4% of retirement plan participants with access actually use this option. Retirement savers using these accounts generally have higher incomes and higher plan balances, with the average account balance falling just under $250k.

A self-directed brokerage account is an option that opens up access to a network of mutual funds. Some SDBAs may allow investments in stocks, bonds, and exchange-traded funds, as well. When retirement savings are placed in an account like this, investments are allocated to investments apart from those available in the core plan.

The accounts may come in the form of a "mutual fund window" providing access to thousands of funds to choose from. Some plans give investors access to a more flexible “brokerage window” account that may allow you to invest in mutual funds, exchange-traded funds, and even individual stocks and bonds. The main concept is to give more choices to a more hands-on investor.

If your plan has one of the following custodians, I may be able to work within your plans SDBA using The Pacific Financial Group (TPFG) and one of their 36 models featuring Investment Managers like Capital Group/American Funds, Fidelity, JP Morgan, MFS, PIMCO, BNY Mellon, Invesco and Janus Henderson. These are the custodians that participate:

• Aspire – Managed Account (most NYS School Districts)

• BOK Financial – Self-Directed Brokerage Account

• Empower – Empower Brokerage Services

• Fidelity – BrokerageLink®

• Prudential Brokerage – Self-Directed Brokerage Account • Schwab – Personal Choice Retirement Account (PCRA)

• TD Ameritrade – Self-Directed Brokerage Account

• TIAA – Brokerage Services

If you are interested in finding out if I can help you-just let me know the name of your employer’s plan. Here is a partial list of well-known plans I can work with:

Virtually all NYS School Districts, Delta Airlines, Dow Corning, Duke Energy, Eastman Chemical, Fedex, Frontier, Gannett, Harris Corp, Hewlett-Packard Packard, Home Depot, Kodak, Deferred Comp plans in Florida, NY, and PA, Red Cross, Time Warner, United Airlines, University of Rochester, UPS, Wegmans.

Best regards,

Marc

Marc R. Gillespie, CLU, ChFC, CFS, MSM, CLF